Business case: Increasing the recycling rate of flexible plastic packaging, Israel

Baseline analysis and challenge1

In Israel, flexible and rigid packaging are recycled together. According to a waste mapping of the flexible packaging waste stream segmentation in Israel only 23% of collected flexible packaging is efficiently sorted for further recycling.

Two main challenges contribute to the low recycling rate. The first challenge is related to the widespread use of flexible packaging composed of multi-material, involving a mix of polymers like Polyethylene (PE), Polypropylene (PP), and Polyethylene terephthalate (PET). Because of this complex composition, the multi-material packaging is difficult to sort, recycle and are therefore often sent to incineration or landfilling.

The second challenge is related to the flexible packaging size. Packaging smaller than A4, even if the composition is mono-material, cannot be automatically sorted by the existing waste sorting technology in Israel. Instead, small flexible packaging is directed to the Refuse-Derived Fuel (RDF) facilities. Only packaging that meets both size and composition criteria is recognized by the near-infrared technology and is sorted for recycling.

The pilot project and solution

Since 2019, the United Nations Industrial Development Organization (UNIDO) has within the regional EU-funded SwitchMed Programme focused on improving the circularity in Israel’s plastic value chain. Together with industry associations, government institutions and sector experts, UNIDO has engaged local stakeholders to demonstrate a business model that can reform the handling of plastic packaging in Israel. to identify opportunities that can increase flexible packaging recycling rates and facilitating closed-loop recycling schemes.

The pilot project had several key objectives, including assessing the flexible packaging market, encouraging the adoption of monomaterial packaging, demonstrating the recyclability of monomaterial flexibles, testing recycled material compatibility with new packages, simulating value chain scenarios for higher rate of flexibles, and assessing the need for investment in advanced sorting equipment.

The project approach

A comprehensive waste assessment was conducted in three major cities in Israel, covering the southern, central, and northern regions. The number of sampled bins in each city was determined based on the city’s population size to ensure a representative and proportionate sample, resulting in 14 bins in Tel Aviv, 9 in Haifa, and 7 in Ashdod. Following the sampling process, the acquired data underwent expert categorization and meticulous analysis to derive valuable insights. This involved, sorting packages into flexible and rigid categories, further classifying flexible packages based on typology and size, and analyzing their composition to identify mono-material or multi-material components and weighed accordingly.

Lab tests were conducted in partnership with the Israel Plastic & Rubber Center, a national R&D institute to assess the chemical and mechanical properties of recyclates containing increased ratios of flexible materials in relation to packaging specifications for non-food grade rigid packaging. This step was crucial in demonstrating that, even with higher levels of flexibles, the recycled material could still meet the necessary packaging specifications, ensuring the feasibility of recycling processes.

The results and key takeaways

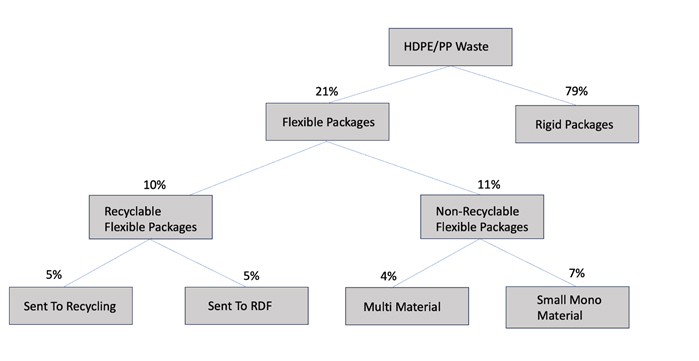

Infographic: Waste sampling results

Assessment of the flexible packaging market

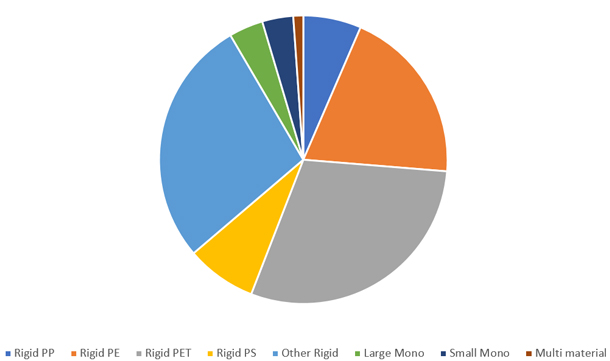

The waste sampling results revealed that rigid packages constitute 88% of the total packaging waste by weight, while flexible packages account for only 12%. Within the HDPE/PP waste stream, 21% consists of flexible packages, with the remaining 79% being rigid packages. Among the flexible packages, recyclable ones make up 51% of the waste stream, while the remaining 49% are non-recyclable, either due to their size or material composition. According to TMIR return of experience, it is estimated that approximately 25% of flexible packaging is efficiently recycled, with 50% of large flexibles (51% of HDPE/PP flexibles) being sorted and sent for recycling. When examining non-recyclable flexible packages, 39% are multi-material, and 61% are mono-material packages smaller than A4.

These investigations enabled to quantify and determine the typology of this an untapped deposit of plastic material, thus providing evidence-based information to further address the limiting factors in increasing the recycling rates of flexible packaging in Israel.

Lab results simulating scenarios for increased recyclable flexibles

The material subjected to testing was a recycled mixed waste stream containing both rigid and flexible packages, sourced and delivered by TMIR’s recycling partner, Plastic City. To assess the viability of incorporating higher proportions of recyclable flexibles in the recyclate composition, simulations were conducted during the initial laboratory tests. This crucial step aimed to demonstrate that even with increased levels of flexible materials, the resulting recyclate would comply with essential packaging specifications. Utilizing data from waste stream sampling, the tests were carried out with a waste stream comprising 15% flexibles in the HDPE category and 20% flexibles in the PP category. This scenario simulated a condition where all flexible packages, as identified through segmentation analysis, were sorted and successfully processed by the recycler.

HDPE results

The analysis of laboratory test results for the HDPE material revealed the following findings: The Melt Flow Index (MFI) fell within the specified range of 0.30 to 0.70, demonstrating compliance. Ash content also met the required criteria. However, the density was lower than the specified range, indicating the need to increase it. Following consultation with Israeli plastic additive company ‘Tosaf,’ a subsequent test incorporated a 7% Calcium Carbonate Masterbatch additive to improve density. The results were as follows: MFI increased slightly to 0.73, density significantly improved to 1.01, confirming the positive impact of the Calcium Carbonate Masterbatch additive on density and MFI, thus meeting specification requirements. The incorporation of calcium carbonate fillers in plastic products not only results in cost savings and improved productivity but also offers environmental benefits by reducing greenhouse gas emissions, minimizing petrochemical and energy usage, and lowering the overall carbon footprint of the end-use plastic products.

PP Results

The initial laboratory test results for the PP material did not meet the application specification requirements, particularly falling short in terms of Melt Flow Rate (MFR), Tensile Stress at Yield, and Flexural Modulus. After consulting with an additive technology expert from ‘Tosaf,’ 0.05% of CRPP (a PP flow enhancer) was added to improve the MFR. Subsequent testing showed an increased MFR but still insufficient Tensile Stress at Yield and Flexural Modulus. Additional testing and adjustments, including increasing the amount of additive are necessary to ensure compatibility with the stringent application requirements are recommended (but due to “logistical constraints”, this additional test was not conducted.)

The outcomes of the lab tests demonstrate that incorporating a flow-enhancing additive has improved specific properties of the PP material, especially Melt Flow Rate (MFR). However, the tested formulation with 20% flexible packaging waste did not meet application specifications. Increasing the additive to 1.5% and exploring trial-and-error methods offer potential enhancements. Further testing and adjustments are required to ensure compatibility with the application’s requirements. With regards to HDPE material, the test results confirm the compatibility of the formulation, including an increased ratio of flexible packaging waste, with the application’s specifications. This demonstrates that, even with a higher proportion of flexible packages in the mixed stream, the material remains suitable for closed-loop recycling into new packaging.

Flexible packaging Monomaterial transition financial projections:

An economic impact simulating the transition towards monomaterial was conducted along the value chain to quantify financial implications on Brands, TMIR and recyclers. The outcomes of these simulations revealed that:

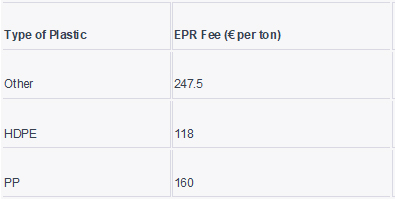

Brands: Within the current EPR scheme, given the minimal impact of the low EPR fees imposed by TMIR, these cost savings have negligible influence on brands’ decision-making processes. Consequently, implementing additional market-wide intervention mechanisms becomes imperative to incentivize brands to transition to mono-material packaging designs.

Additional costs/Savings (€ per ton) for Brands Transitioning to Mono Material Packaging

TMIR: The analysis of diverse waste management scenarios indicates significant financial advantages for TMIR compared to the current state. Scenario B, which capitalizes on converting waste to Refuse-Derived Fuel (RDF), Polypropylene (PP) income, and revenue from downcycling, emerges as the most profitable option. Following closely is Scenario D, which incorporates similar benefits along with High-Density Polyethylene (HDPE) income. In comparison to the current situation where multimaterial packages are sorted into the ‘Other’ waste stream, Scenario A forecasts a 53% total revenue increase, while Scenario B stands out with a 74% revenue increase. Scenario C estimates a 36% rise in total revenue, and Scenario D, ranking third, anticipates a 57% revenue increase. It is important to note that Scenarios A and C offer a 20% discount to Plastic City in case the material goes for closed-loop recycling, making them less lucrative for TMIR, indeed TMIR prefers foregoing additional revenues associated with Scenarios B and D, as long as the material is recycled in a closed loop.

Recyclers: The HDPE/PP flexible packages, when sorted, are directed to the PE/PP waste stream, sold to Plastic City for recycling at €250 per ton (with a 20% discount for packaging applications, scenarios B and C). Plastic City transforms these materials into HDPE and PP, currently sold at €750 per ton for secondary uses, resulting in a profit margin of €500 per ton.

Currently, recycled plastic suitable for downcycling has a market price of €750 per ton for both PP and HDPE. Comparative data from the Manufacturers Association of Israel reveals that the prevailing prices for virgin PP and HDPE are €1335 and €1320. This data indicates the effective competitiveness of recycled materials in comparison to virgin plastic, thus creating an economic favorable environment for applications of plastic recyclates and increasing close loop circular schemes in the plastic value-chain.

Environmental impact/ Economic impact

With an estimated flexible packaging market of close to 90,000 tons annually, which includes industrial applications, shrinks, as well as secondary and tertiary packages that do not reach the end consumer, transitioning Israel’s flexible plastic packaging to mono-materials presents a significant economic opportunity. This shift could lead to a substantial increase in recycling, with the potential to add 600 tons to the existing recycling capacity of Tmir collected bins. Extrapolating this figure across the entire value chain indicates a total recycling potential of 4,200 tons.

Furthermore, with an anticipated Compound Annual Growth Rates (CAGR) ranging from 4.5% to 6% over the next five years, the flexible plastic market in Israel could attain an annual production volume between 120,000 and 135,000 tons. This substantial growth potential associated with the financial projection underscores the economic viability of transitioning to monomaterial packaging, positioning Israel favorably within the global market while simultaneously fostering environmental sustainability through enhanced recycling initiatives.

Brands that embrace the use of resins made from recycled of flexible packaging and adopt a transition towards monomaterial packaging can contribute to significant cost savings across the value chain while reducing their environmental footprint . In absolute figures, 600 Tons out of 90 000 seems insignificant, but flexible packages, light and volatile have tremendous environmental impact on litter and marine ecosystems, way more than its mass itself. XXX

Conclusion/Recommendations

The pilot provided valuable insights into the challenges and opportunities in enhancing the recycling rates of flexible packaging in Israel. Based on the outcomes of the analysis, projections and testing process, a set of recommendations can be drawn to support the adoption and upscale at national level:

In the realm of regulatory standards governing plastic packaging in Israel, only two standards, SI 471 established in 1963 and SI 556 introduced in 1980, pertain to plastic packaging. Importantly, these standards exclusively address monomaterial packaging, thus creating a regulatory gap for producers and importers when it comes to multimaterial packaging. It is therefore recommended to consider the adoption of relevant international standards, in particular, Films and sheeting ISO standards such as ISO 15988 and ISO 13636 for PET and ISO 17555 and ISO 17557 for PP that could serve as valuable references and comprehensive guidelines for industrial applications of monomaterial and multimaterial packaging.

Building up on the Israeli Packaging law established in 2011, that sets the guiding principles of the EPR scheme in Israel and considering the untapped potential for revenue increase through the sorting of flexibles not currently part of recycling schemes, investments in advanced sorting equipment, such as additional Near Infrared sensors for the 2D stream and a suitable ballistic separator for light materials, are essential. These investments should go back-to-back with reconsideration of waste handling fees: the gradual increase of landfill fees while concurrently promoting recycling and alternative waste management solutions. Disposal fees for waste-to-energy and incineration should be set at a level lower than landfilling fees but higher than recycling schemes.

Additionally, supporting brands by identifying underperforming entities and/or worst packages, providing grants, subsidizing professional assistance, and directing efforts towards redesigning flexible packaging to monomaterial and to match TMIR sorting capacities can significantly enhance flexibles sorting and recycling rates, initiating a virtuous circle that prolongs the material life cycle of plastic and contributes to sustainable waste management practices.

While increasing recycling rates and sorting capacities are essential, encouraging brands to embrace recycled materials is of utmost importance. The industry’s widespread adoption of recycled materials can be achieved through a combination of premium pricing strategies and strategic incentives. Manufacturers can capitalize on this trend by highlighting the recycled content in their packaging, employing effective marketing techniques to capture market attention.

These incentives can be in a form of subsidies or tax benefits that encompass supporting the use of recyclable materials in packaging, encouraging the incorporation of post-consumer recycled content, and funding initiatives aimed at redesigning packaging to incorporate recyclates. These incentives not only reduce costs for consumers but also provide a competitive advantage in the market and can support the widespread adoption of packaging products made from recycled materials among manufacturers, thus fostering an upward trend of flexible packaging maintained in circular schemes across the plastic value chain in Israel.

For more information contact:

United Nations Industrial Development Organization

Ms. Ulvinur Müge Dolun

Division of Circular Economy and Environmental Protection Circular Economy and Resource Efficiency Unit

Vienna International Centre, P.O. Box 300, 1400 Vienna, Austria E-mail: u.dolun@unido.org Web: www.unido.org

Visit SwitchMed.eu

Funded by the European Union, with co-funding from the Government of Italy and the Government of Catalonia, the SwitchMed Programme is implemented under the lead of the United Nations Industrial Development Organization (UNIDO). Under the MED TEST III project pathways for industries in the Southern Mediterranean to become more resource efficient and to generate savings for improved competitiveness and environmental performance.

Disclaimer:

This publication was produced with the financial support of the European Union and within the framework of the EU-funded SwitchMed programme. Its contents are the sole responsibility of UNIDO and do not necessarily reflect the views of the European Union.

Infographic options:

1. HDPE/PP waste stream tree

- Waste sampling results pie, ex:

List of files for download